blog | Kit Livingston

| October 18, 2017 12:18 pm

| Leave a Comment

| mobile cost management, MobilSentry, wireless expense managment

Are Your Corporate Mobile Devices Being Used for Entertainment?

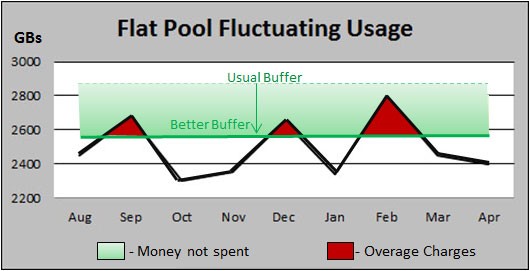

The question today is no longer whether employees are using their mobile devices for entertainment but how much it is costing your company? The fuel for the 300% industry-wide increase in mobile data usage in the last two years is entertainment related activities, most prominently video streaming. Studies show data usage is projected to quadruple by the year 2021. If companies doesn’t get a handle on this new expense challenge, mobile budgets are on target to experience a growth rate of 20-30% a year.

The question today is no longer whether employees are using their mobile devices for entertainment but how much it is costing your company? The fuel for the 300% industry-wide increase in mobile data usage in the last two years is entertainment related activities, most prominently video streaming. Studies show data usage is projected to quadruple by the year 2021. If companies doesn’t get a handle on this new expense challenge, mobile budgets are on target to experience a growth rate of 20-30% a year.

What If You Could Actually Know Which Sites are Visited?

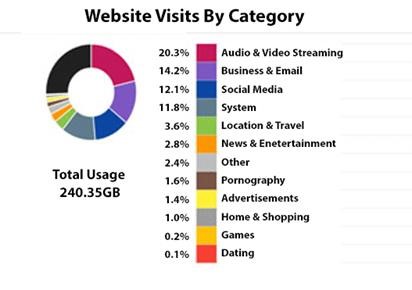

If you think your employees are just using their business smartphones to communicate with corporate applications, think again. Since carriers don’t provide the actual sites your employees are visiting on their mobile devices, you may be under the impression it is primarily business usage. While the carriers don’t provide actual site information, MobilSense can. In fact, we think if you could see this kind of information it would dramatically alter your views on usage policy enforcement.

Now is the time for enterprises who assign corporate-owned devices to become more aggressive in identifying and understanding the data consumption of its employees.

Click here to learn how our unique approach to identifying unproductive data use can not only monitor but identify data waste and provide the proactive controls needed to enforce company policy.